This is a paid advertisement on behalf of NetraMark Holdings Inc. Please review the forward-looking statements and legal disclaimers at the end of this article for important details.

Special Opportunities Report

AINMF:OTCQB | AIAI:CSE

President Trump just announced plans to invest $500 BILLION into AI infrastructure – the largest AI investment in history.

And that’s why we’ve picked little-known NetraMark Holdings (AINMF:OTCQB, AIAI:CSE) as…

Our Top AI Pick For 2025

NetraMark Holdings (AINMF:OTCQB, AIAI:CSE) is developing a disruptive artificial intelligence platform that could make waves in the $1.48 TRILLION-dollar pharmaceutical industry.

Read on to discover the 6 reasons why NetraMark Holdings (Ticker: AINMF on the OTCQB, or AIAI on the CSE) may be our top AI company this year…

Why we believe the company’s novel NetraAI platform could one day be used by pharmaceutical companies worldwide…

And how a single trigger could expand NetraMark’s business… potentially leading to an increase in sales and even possibly what we call “the multiplier effect”.

NetraMark Holdings (AINMF:OTCQB, AIAI:CSE)

Fellow Investor,

Get ready…

Because you’re about to discover why we believe NetraMark Holdings Inc. (AINMF:OTCQB, AIAI:CSE) could quickly become Investing Insider’s top performing AI pick of the year.

You’ll see…

- How NetraMark’s artificial intelligence solutions could help mitigate one of the pharmaceutical industry’s biggest problems.

- How the company’s proprietary NetraAI platform could potentially help drug developers get life-saving treatments to market quicker while helping protect their multi-million dollar clinical trial investments – making adoption of the platform a ‘no brainer’ in our opinion.

- And how just one successful clinical trial with a major pharmaceutical company could increase sales, and could lead to potentially other new contracts in what we’re calling ‘the multiplier effect’.

Listen, AI is one of the hottest investments of the past two years.

Some companies leading the charge have seen a massive uptick in valuations since January 2023…

Microsoft is 74% higher. 1

Meta has surged 377%. 2

And NVIDIA has jumped more than 8-fold… up a whopping 838%. 3

If you missed out on those winners, don’t worry. AI is setting up to be a major opportunity for investors for years to come. In fact…

- The World Economic Forum is calling A.I. “the global growth story of the 21st century”. 4

- The Global Banking & Finance Review calls artificial intelligence “The Future of Investment”. 5

- Even PriceWaterhouseCoopers, the second-largest professional services network in the world, estimates A.I. could potentially contribute $15.7 Trillion to the global economy by 2030 – more than the economies of Japan, Germany, France, and the United Kingdom… combined. 6

Here at Investing Insider, we think one of the biggest opportunities for AI is in healthcare.

In fact, we see the estimated $1.48 trillion pharmaceutical industry being on the cusp of a major AI revolution. 33 And we believe NetraMark (AINMF:OTCQB, AIAI:CSE) could be positioning itself to potentially be a major player in the industry.

Here’s why…

How NetraMark’s AI Platform Could Potentially Disrupt Big Pharma

We’ve looked at dozens of AI companies over the past 6 months.

But NetraMark’s powerful artificial intelligence is unlike anything we’ve ever seen.

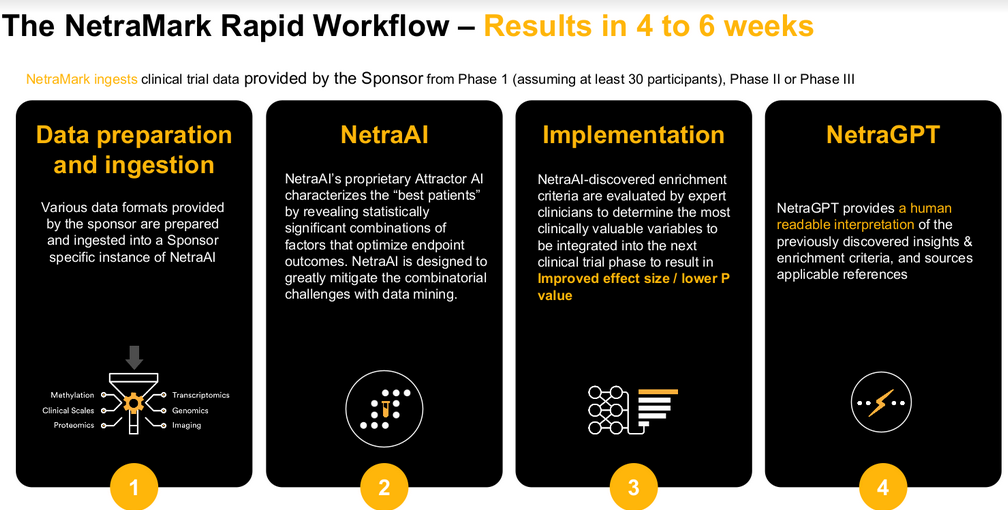

The state-of-the-art NetraAI platform analyzes clinical trial data in an innovative way when compared to traditional research methods. It looks at millions of variables in a matter of minutes, and generates unique insights that help explain why certain patients responded (or didn’t respond) to treatment.

These results can enable researchers to design more effective clinical trials, which could potentially increase the odds of achieving FDA success – an advantage all pharmaceutical companies desire.

That’s why we think NetraMark’s technology could have a big potential impact on the pharmaceutical industry. Not only could NetraAI help companies tip the scales towards a favorable FDA outcome…

But it may help open the doors to a potentially endless customer base of deep-pocketed pharma companies.

It can even be used to analyze data from previous studies… possibly giving new life to failed trials – a prospect which could also be in high demand and potentially very lucrative.

In short, the market potential here is enormous.

Watch NetraMark CEO George Achilleos share how the Company’s advanced technology could help the $1.48 trillion pharmaceutical industry on Sequire Spotlight:

Which is why we’re talking about NetraMark Holdings Inc. (AINMF:OTCQB, AIAI:CSE) today.

NetraMark is quietly courting its first tranche of clients right now.

- In fact, it has established a beachhead client (a Nasdaq listed BioPharma company with a $10B+ USD Market cap and a large late phase pipeline) that has signed 4 contracts during the 2024 fiscal year.

And if the company can successfully prove its technology works, by achieving just a few positive outcomes with a major pharmaceutical company, we believe it could expand NetraMark’s business opportunities.

We’ll explain more on this and the potential upside in just a minute.

But first, let me ask you…

What Would You Do if I Gave You $2.6 Billion?

If you were a pharmaceutical company, your answer would be:

Develop a drug.

Not a handful. Not two or three… but with $2.6 billion, you could maybe develop one, single drug. 7

In fact, the Tufts Center for the Study of Drug Development estimates that the cost to develop one new drug – from discovery through FDA approval – is a shocking $2.6 billion. 8

Of course, the profits of a successful drug could far outweigh the costs. For example…

↪ Pfizer’s pharmaceutical drug Lipitor reportedly generated over $131 billion in sales. 9

This potential windfall is why pharmaceutical companies allocate around a quarter of their revenue to research and development costs each year.

Roche, for example, spent $14.7 BILLION on R&D in 2022… over 30% of the company’s revenues. While Merck’s R&D budget was $13.6 billion, or 23% of total revenues. 10, 11

But while you might think that with such massive sums being spent on drug development annually the odds of success are high…

That’s not the case.

Nearly 90% of Drug Candidates Fail to Reach the Market

After years of research and possibly billions of dollars spent, only about 12% of drugs entering Phase I clinical trials are approved by the FDA. 12

New drugs targeting complex and poorly understood conditions are even less likely to succeed…

Between 2002 and 2012, the failure rate for new drugs targeting Alzheimer’s disease was approximately 99.6%. 34

In fact, Roche – who reportedly spent the most on research and development in 2022 – had 4 of the 10 largest failures that year…

- Phase 2 failures with its Alzheimer drug, Crenezumab.

- Phase 3 failures with another Alzeheimer drug, Gantenerumab – actually called a “resounding failure” by analysts.

- Phase 2 failures for Giredestrant, which was being developed to treat breast cancer.

- And another Phase 3 miss for Tiragolumab – arguably the biggest disappointment for the company. Roche previously flagged the drug as a top prospect in its oncology pipeline, and analysts predicted it could become a ‘blockbuster’! 14

And it’s not just Roche with significant, clinical trial losses in 2022…

- “Phase III Flop Ends Sanofi’s SERD Breast Cancer Candidate”- BioSpace 15

- “Merck & Co. bails on NGM eye disease collab in wake of phase 2 fail” – Fierce Biotech, and… 16

- “Pfizer Cuts Late-Stage Asset For Rare Cardiovascular Acquired Via $11.4B Array acquisition” – Yahoo Finance. 17

Phase III trials alone can cost upwards of $340 million to run 18… yet an estimated 58% of all drugs entering phase III fail. 19

Without a doubt, these late-stage failures can be crippling for drug companies.

Even before entering phase III, pharmaceutical companies have likely spent over 70% of total research costs on development and dedicated 9 years of time 20. That often amounts to hundreds of millions of dollars and thousands of man hours lost.

But what if companies could de-risk these late-stage failures?

And that’s where NetraMark’s proprietary artificial intelligence could fit in.

NetraMark Founder Dr. Joseph Geraci is a PhD mathematician, medical scientist, and quantum machine learning specialist with postdoctoral degrees in machine learning, oncology, and neuropsychiatry.

He recognized that when a clinical trial fails, it’s not necessarily that the drug didn’t work or patients had a bad reaction…

It’s often because only a certain subset of patients didn’t have a measurable response to the treatment.

Dr. Joseph Geraci, NetraMark Founder

NetraMark’s Quantum Breakthrough

You see, one of the main problems with most clinical trials is that the number of patients enrolled is very, very small. Meaning, the data sets are tiny. This makes it extremely challenging to calculate a statistically relevant insight – even with the most advanced technologies.

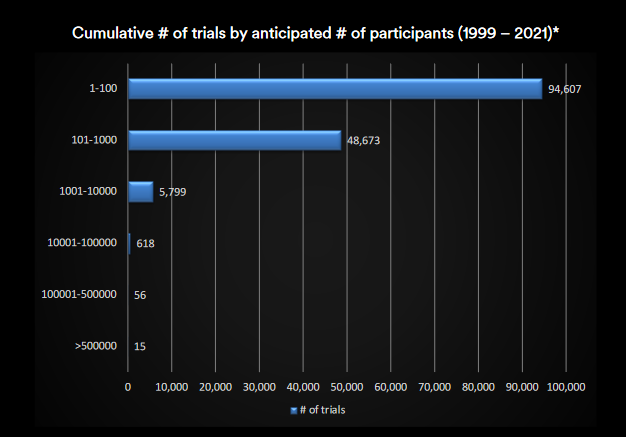

In fact, over 95% of clinical trials have less than 1,000 patients. While over 60% have less than 100. 21

That’s an extremely small sample size, especially when you’re talking about drugs that could potentially be used by millions of people.

Over 95% of trials have less than 1,000 participants:

This is further complicated by the fact that many variables are often associated with these small patient data sets – making the permutations and combinations of possible drivers of response or non-response to a drug endlessly large.

As a result, the ability to find optimal combinations of variables is extremely difficult.

Think of it this way: if you have a data set of 150 patients, each with 1,000 unique variables, the possible combinations of selecting just six different variables from this group is a staggeringly large 20-digit number.

To put that in perspective, the number one trillion (1,000,000,000,000) only has 13 digits.

Using his mathematics and quantum machine learning background, Dr. Geraci contemplated for years how he was going to build a formula – using a very small dataset coupled with a wide level of variables – to stratify the patients in an exceptionally detailed way. One that could help pharmaceutical companies understand precisely how and why different patient populations were responding to drug and placebo.

His breakthrough came in 2012 when he developed “Attractor AI”: a physics engine-based AI that attracts and repels features in order to optimize explainability.

You see, in his quest to go beyond current statistical methods and analysis, Dr. Geraci crafted a unique mathematical approach using magnetics to reveal hidden relationships between variables. This led to the birth of his Attractor AI, which forms the core of NetraAI.

And unlike traditional methods that sort patients simply into drug responders and non-responders, NetraAI’s strategy breaks patients into multiple smaller groups based on specific criteria. It not only identifies closely related patients based on their responses and adverse events, but also uncovers combinations of variables that impact study success.

NetraAI is a product of these breakthrough principles. According to the company, it offers an unique perspective on disease and is perfectly suited for pharmaceutical applications.

– Dr. Geraci

Dr. Geraci’s pioneering AI approach is a trade secret held exclusively by NetraMark.

This ensures the platform will stay proprietary and it could help secure its position in the pharma industry for years to come.

How The NetraMark Platform May Help De-Risk Stage 2 & 3 Trials

NetraAI is a proprietary generative AI algorithm that uses unsupervised machine learning to analyze and stratify clinical data.

The system isn’t limited to our ‘pre-existing knowledge’ or our ‘existing classifications of disease’. It learns from the data and creates its own identifiers by sorting patients into distinct categories based upon thousands of factors.

It’s also capable of ingesting an extremely small dataset to generate conclusions on what factors cause a response to the drug.

More specifically, NetraAI analyzes data to…

- Determine the influential variables of sub-populations that responded or didn’t respond…

- Draw connections between these variables, the response, and the disease…

- Create hypotheses about which sets of variables may best respond to the treatment.

Plus, it’s fast.

Whereas previously analyses used standard statistical analyses that could take weeks for scientists to analyze and still not find the hidden

subpopulations, NetraAI could find them in hours.

The report also pioneers something it’s calling “Explainability”.

- NetraAI’s Explainability uncovers connections related to efficacy, toxicity, and placebo response, enabling researchers to improve drug testing.

For example, using Phase 2 data, NetraAI can provide a pharmaceutical company a prioritized list of the top variables associated with a subset of patients who

responded to the drug. Pharmaceutical company can then look to recruit more patients with similar characteristics for its Phase 3 trials.

It’s like stacking the deck – but in a completely FDA compliant and legal way.

Normal clinical trial guidelines must still be followed (such as double-blind placebo randomization). But NetraAI helps scientists find the most suitable patient types – ones more likely to respond to treatment – so they can run more effective clinical trials.

This could be a game-changer for the pharmaceutical industry!

- It potentially increases the odds of successfully moving through clinical trials by figuring out the underlying mechanisms of the drug and determining the ideal patient type.

NetraAI has been fully validated in compliance with GxP Guildelines and FDA Regulations

NetraAI is one of the few AI systems to be fully validated in accordance with GxP Guidelines and FDA regulations (including 21 CFR Part 11 and 820).

NetraMark Makes Significant Discoveries in Fight Against Alzheimer’s Disease.

In a recent whitepaper NetraMark announced it made significant discoveries and uncovered unique perspectives that could help the fight against Alzheimer’s disease.

Specifically, NetraMark was able to use a relatively small publicly available Alzheimer’s disease gene expression dataset and stratify samples from Alzheimer’s disease patients by 6 progression mechanisms that contribute to Alzheimer’s disease heterogeneity.

NetraAI’s findings also identified the implication of GTSE1 and TUBB1 genes as being important factors for a subtype of Alzheimer’s. The results could have an impact on future clinical trials and could potentially help researchers identify new treatments.

NetraMark Inks Major NASDAQ-listed Client

In the current fiscal year, NetraMark established a beachhead client (Nasdaq listed BioPharma company with a $10B+ USD Market cap and a large drug pipelines) and has signed 4 contracts, in the 2024 fiscal year.

Based on this success, NetraMark is currently discussing additional projects to further aid the client in their clinical research programs.

In addition, over the past 18 months, NetraMark has been focused on building leads. Since April of 2023, the Company has grown the leads in the pipeline from 19 to over 130+ leads and over 30 potential channel partners in the partner pipeline.

We Think NetraMark Could Be Highly Beneficial for Its Prospective Customers

So, you’ve seen how insanely expensive clinical trials can be…

You’ve seen the super-high failure rates…

You’ve seen what NetraAI is capable of and how it can help…

And you’ve seen that it had real life success…

Now, let me ask you…

If you’re a drug company, and you just spent hundreds of millions of dollars taking a drug through Phase II trials…

And you know that over half of all drugs entering Phase III will fail…

Wouldn’t you want to do anything you could to help your drug trial succeed?

Would you be willing to spend an extra 1% of your budget to run an analysis that could tip the scales in your favor? What about 0.5%?

For a relatively small fee, NetraMark’s technology could possibly save drug developers hundreds of millions in R&D losses.

In our opinion, the adoption of this technology by prospective customers could be a no-brainer.

And if NetraAI can help one of these major pharma companies achieve just one successful outcome, we think it could lead to increased sales and possibly even what we call ‘the multiplier effect’…

“The Multiplier Effect”

And Why We Think it Could Expand the Business of NetraMark (AINMF:OTCQB, AIAI:CSE)

You see, large pharmaceutical companies don’t run trials for only one drug at a time… they run hundreds!

- Pfizer sponsors over 200 clinical trials each year. 22

- Roche is reportedly conducting around 400 clinical trials. 23

- And Sanofi has been known to conduct over 550 clinical trials – in just one calendar year! 24

In fact, there are over 450,000 registered clinical trials around the world today… 25

That’s a massive potential market… and a major positive for NetraMark.

But here’s where it gets really interesting…

Currently, NetraAI is charging between $100,000 and $350,000 for each drug in a clinical trial – what could equate to just 0.01% of the drug’s overall R&D budget…

Or mere peanuts compared to the average $2.6 billion drug cost.

If NetraMark can prove its technology works in a real world application, we believe it’s highly likely a company might adopt it across dozens – or perhaps all – of their clinical trials.

- And we think that could have the potential to quickly multiply NetraMark’s sales.

Further, as more contracts are successfully completed, NetraMark could potentially increase the fees charged which would also have an impact on revenue.

Just think about it…

If NetraMark is able to secure a contract for one trial, that’s a potential for $300k in revenue. If it can secure 12 trials, revenues could potentially increase to $3.6 million (with a possible gross margin profile of over 90% for each project).

And if a major pharmaceutical company adopts it across their entire drug portfolio…

Revenues could possibly multiply several-fold.

Now, let us be clear there is no indication that the company will achieve any sales revenues like this now or in the near future – or ever. In fact, the company is still courting its first potential clients.

But this example underlies the potential application of NetraMark’s technology. We believe the company just needs to get its foot in the door with a couple potential clients and if it can prove successful, it could result in multiple ongoing contracts.

And speaking of getting their foot in the door…

This is something we have confidence in management achieving because…

NetraMark is Run By a Team of Highly Connected Industry Experts

In addition to mathematical genius and quantum machine learning specialist Dr. Joseph Geraci, NetraMark has assembled some top industry experts with deep ties to the pharmaceutical industry to help the company seek opportunities to grow:

George Achilleos, CEO

- George is a seasoned Business Executive with 25+

years of experience, that began in the technology

sector at IBM. He has led over $50M of business

deals and transactions and has generated over

$70M+ of revenue in his career. He has been in

senior executive positions in the Digital Strategy, E-

Commerce, Nano Technology and Retail industries

and has served in advisor board roles in the media,

clean energy and plant-based foods sectors.

Joseph Geraci, Ph.D. | Founder, Chief Scientific and Technical Officer

- Dr. Joseph Geraci, Ph.D. is a mathematician, medical scientist, and quantum machine learning specialist. He holds postdocorates in machine learning, oncology, and neuropsychiatry. He has developed novel machine intelligence algorithms that are capable of providing extraordinary insights into complex data sets, like those found in clinical trials. He is associated with the Department of Molecular Medicine and Pathology at Queen’s University in Ontario, Canada, and the Centre for Biotechnology and Genomics Medicine Medical College of Georgia, USA.

Dr. Luca Pani, Chief Innovation and Regulatory Officer

- Dr. Luca Pani, MD, is the former Director-General of the Italian Medicines Agency and has extensive experience working with global regulators. He is author of over 200 peer-reviewed scientific publications and author of 26 books. He is a recognized expert in basic and clinical pharmacology and regulatory science, emphasizing health technology assessments linked with a large web-based clinical dataset to guide novel approval and negotiation strategies.

Dr. Larry Alphs, Chief Medical Officer

Dr. Larry Alphs, MD, PhD, is a pharmacologist and psychiatrist with 30+ years of experience treating psychiatric patients and leading clinical trials in academia and pharma. He has led several landmark studies in schizophrenia and depression and has developed several clinical scales that are used in psychiatric research settings. He is a founder and past president of a leading society focused on developing better methodology in CNS clinical trials (ISCTM).

Josh Spiegel, President

Mr. Spiegel brings 25-plus years of experience in finance, sales and corporate strategy, with a strong background in health care, business services and technology. Prior to joining NetraMark, he was the vice-president of business strategy at VeraSci, where he leveraged his experience to provide strategic planning and oversight of commercial operations, including the launch of the Pathway eClinical platform and positioned the company for a highly successful $330-million (U.S.) exit to WCG Clinical, a leader in the pharmaceutical services sector.

NetraMark Holdings (AINMF:OTCQB, AIAI:CSE) Looks to be Our Top AI Pick of the Year

The artificial intelligence market is red-hot right now:

- The World Economic Forum is calling A.I. “the global growth story of the 21st century”. 27

- The Institution of Engineering and Technology says, “AI is the investors’ Next Big Thing”. 28

- And Forbes is reporting on the, “Disruptive Economic Impact of Artificial Intelligence”. 29

From Nvidia — the chip maker that became an AI superpower 30 and saw its business grow over 700% in the past two years 3…

To Microsoft — and its $10 BILLION investment in OpenAI, the creator of the artificial intelligence chatbot, ChatGPT…

To Stability AI’s ground-breaking text to image generator, Stable Diffusion – which reportedly QUADRUPLED the company’s business in only 7 months. 32

NetraMark Holdings (AINMF:OTCQB, AIAI:CSE) could be the potential AI breakthrough the pharmaceutical industry has been waiting for.

The company’s proprietary platform, NetraAI, enables researchers to identify the best patient candidates for studies…

It empowers companies to potentially run more successful trials…

Listen…

With the average cost of a new drug hitting $2.6 billion, NetraAI could potentially save drug developers millions every year.

We think the potential here could be enormous.

There are over 450,000 clinical trials underway right now.

If NetraMark can successfully achieve just one positive clinical outcome, it could lead to additional sales… something we believe could potentially significantly expand the company’s business.

Six Reasons NetraMark Holdings Inc. (AINMF:OTCQB, AIAI:CSE) Is Our Top AI Pick Today:

1)

State-of-the-Art Artificial Intelligence:

- The $1.48 TRILLION pharmaceutical industry could be next in line to benefit from the ongoing AI revolution. NetraMark’s innovative proprietary platform uses state-of-the-art machine learning to redefine the clinical trial process.

2)

A Potential ‘No-Brainer’ for Drug Companies:

- The estimated cost to bring just one drug to market is $2.6 billion, and typically takes 10 to 15 years’ time. With a price point of just $100 to $350k, NetraAI could equate to just 0.01% of the drug’s overall R&D budget… And when Phase III trials alone can cost over $340 million, NetraAI could be a compelling solution for drug companies to help de-risk their clinical trials.

3)

The Multiplier Effect Could substantially increase Sales:

- Pharmaceutical companies aren’t usually in trials for just one drug… but many. Just one success with one drug could significantly increase NetraMark’s revenue – if that pharmaceutical company begins to enlist NetraAI for all of their trials.

4)

A Team of Connected Experts:

- Dr. Joseph Geraci, the mathematical genius who created NetraAI, is just one part of NetraMark’s secret sauce. The company is supported by a full team of AI and pharmaceutical experts with deep ties to the pharmaceutical industry including former executive positions at Pfizer, Novartis and J&J – which could help to get NetraMark’s foot in the door with the top companies across the globe.

5)

Unique Approach:

- There are very few options like NetraAI on the market today. The platform is unique in its ability to analyze an extremely small data set to redefine the way we understand and diagnose disease, on an easy to use and interactive platform.

6)

READY FOR MARKET TODAY & ALREADY LANDING NASDAQ-LISTED CLIENTS:

- NetraMark has gone through 7+ years of product development, a lengthy quality assurance process that meets GxP Guidelines and FDA regulations. The company has already successfully landed contracts with a NASDAQ-listed biopharma company, meaning NetraAI is ready to hit the market today!

NetraMark Holdings Inc.

Tickers:

AINMF:OTCQB

AIAI:CSE

Click Here to Download a free investor information package

Want to learn more?

Watch NetraMark’s corporate update and outlook on opportunities ahead here:

Forward-Looking Statements and Legal Disclaimers – Please Read Carefully.

This news release contains certain forward-looking statements within the meaning of applicable securities laws. All statements that are not historical facts, including without limitation, statements regarding future estimates, plans, programs, forecasts, projections, objectives, assumptions, expectations or beliefs of future performance, are forward-looking statements. Forward-looking statements in this material include that AI technologies will be utilized and implemented by the rapidly growing pharmaceutical industry; that NetMark Holdings Inc. (the “Company”) is developing a disruptive/state of the art AI platform that could impact the estimated $1.48 trillion pharmaceutical industry; that the Company’s proprietary AI technology will be a breakthrough in the industry as it increases the efficiency and de-risk the clinical trial process of pharmaceutical companies; that the Company’s technology can unlock a major market opportunity for the company; that the Company’s technology is ideal for the pharmaceutical companies and how the multiplier effect could expand the Company’s business in this context; the Company can open potential market opportunities for pharma companies’ clinical trials; that the Company’s technology provides a unique solution for the AI industry and pharma industry in particular; that the Company’s technology could disrupt big pharma industry by providing proprietary analysis of clinical trial data and related variables, by saving substantial costs and increasing odds of FDA approval success; that the adoption of the Company’s technology will save pharma companies’ money and expedite FDA approvals making it a “no brainer” for prospective customers; that the Company’s will increase substantially if it can prove its technology works in a real world application; that the Company’s management team has the experience, expertise and connections to obtain contracts with pharma companies to utilize the Company’s technologies; that the Company’s technologies will be adopted by pharmaceutical companies to identify patient candidates, run successful trials and increase odds of FDA approval odds; that the Company’s innovative proprietary platform will utilize state-of-the-art machine learning to redefine the clinical trial process, saving pharmaceutical companies significant costs and rapidly growing the Company’s business and revenues; that the Company’s approach will remain unique in the market place and will be favorable to competing technology platforms; that the Company will be able to raise sufficient funds or generate revenues to sustain and develop its business and plan of operations;. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that that AI technologies may fail to be utilized and/or implemented by the pharmaceutical industry as expected; that the Company’s technology may fail to be disruptive/state of the art and fail to gain any significant market share; that the Company’s technology will not achieve its aims of increasing the efficiency and de-risking the clinical trial process; that alternative technologies may be preferred or more widely accepted by customers; that the Company may fail to adequately protect its technology, trade secrets and processes; that the Company’s technology may be copied, duplicated or otherwise fail to gain competitive advantages; that the Company’s technology may fail to work as intended or may otherwise not deliver the anticipated results; that the Company’s management team may fail to implement the Company’s business plan or obtain any contracts for adoption of the technology platform of the Company; that the Company’s technology will not be adopted by pharmaceutical companies to identify patient candidates, run successful trials or increase odds of FDA approval odds, or will fail to achieve these goals; that the technology will not save pharmaceutical companies significant costs and rapidly grow the Company’s business and revenues; that competing and/ or similar technologies will be developed and obtain competitive advantages; that the Company will be unable to raise sufficient funds or generate any revenues to continue its business and plan of operations;; that the Company will fail to achieve similar exploration and development success on its properties as was achieved on adjacent properties; that the Company may fail to obtain sufficient financing or cash flows to continue its explorations and operations.; that the Company may have no lithium reserves on its properties whatsoever and fail to achieve similar results as adjacent properties; that the Company may suffer negative and unforeseen consequences from the COVID-19 pandemic or future pandemics; that the Company may ultimately fail to successfully implement its business plans, raise capital or generate any significant revenues. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

6

1 – https://finance.yahoo.com/quote/MSFT/history?p=MSFT (opening price of $243.08 on Jan3, 2023 to closing price of $421.50 on December 31, 2024)

2 – https://finance.yahoo.com/quote/META/history?p=META (opening prices of $122.82 on Jan3,2023 to closing price of $585.51 on December 31, 2024)

3 – https://finance.yahoo.com/quote/NVDA/history?p=NVDA (opening price of $14.31 on Jan3,2023 to closing price of $134.29 on December 31, 2024)

4 – https://www.weforum.org/agenda/2023/01/global-growth-story-of-the-21st-century-lse-grantham-systemiq-davos2023/

5 – https://www.globalbankingandfinance.com/artificial-intelligence-the-future-of-investment/

6 – https://www.pwc.co.uk/services/human-resource-services/insights/is-workforce-ready-for-ai.html

7 – https://sitn.hms.harvard.edu/flash/2020/modern-drug-discovery-why-is-the-drug-development-pipeline-full-of-expensive-failures/

8 – https://www.eidasolutions.com/the-pharmaceutical-industry-in-figures/

9 – https://vakilsearch.com/blog/what-is-the-most-profitable-pharmaceutical-drug-ever/

10 – https://www.drugdiscoverytrends.com/top-pharma-rd-spenders-2022/

11 – https://www.fiercebiotech.com/biotech/top-10-pharma-rd-budgets-2022

12 – https://www.policymed.com/2014/12/a-tough-road-cost-to-develop-one-new-drug-is-26-billion-approval-rate-for-drugs-entering-clinical-de.html

13 – https://www.pharmaceutical-technology.com/features/featurecounting-the-cost-of-failure-in-drug-development-5813046/

14 – https://www.fiercebiotech.com/special-reports/2022s-top-10-clinical-trial-flops

15 – https://www.biospace.com/article/phase-iii-flop-ends-sanofi-s-breast-cancer-serd-candidate/

16 – https://www.fiercebiotech.com/biotech/merck-co-bails-ngm-eye-disease-collab-wake-phase-2-fail

17 – https://finance.yahoo.com/news/pfizer-cuts-stage-asset-rare-174713321.html

18 – https://ftloscience.com/process-costs-drug-development/

19 – https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6609997/

20 -https://ftloscience.com/process-costs-drug-development/

21 – NetraMark Deck 2023, slide 11

22 – https://www.pfizer.com/science/clinical-trials/guide-to-clinical-trials/meet-people

23 – https://www.koreabiomed.com/news/articleView.html?idxno=21181

24 – https://www.prnewswire.com/news-releases/sanofi-accelerating-future-breakthroughs-through-clinical-trials—part-1-of-3-300647127.html

25 – https://www.statista.com/statistics/732997/number-of-registered-clinical-studies-worldwide/

26 – https://www.fiercebiotech.com/biotech/top-10-pharma-rd-budgets-2022

27 – https://www.weforum.org/agenda/2023/01/global-growth-story-of-the-21st-century-lse-grantham-systemiq-davos2023/

28 – https://eandt.theiet.org/content/articles/2023/01/money-markets-ai-is-the-investors-next-big-thing/

29 – https://www.forbes.com/sites/bernardmarr/2022/10/19/the-disruptive-economic-impact-of-artificial-intelligence/?sh=6257b0f940b7

30 – https://www.bbc.co.uk/news/business-65675027

31 – $148.51 open on January 3, 2023 to $424.13 close July 3, 2023.

32 – https://synthedia.substack.com/p/stability-ai-is-raising-funds-at

33 – https://www.statista.com/statistics/263102/pharmaceutical-market-worldwide-revenue-since-2001/

34 – https://www.pharmaceutical-technology.com/features/featurecounting-the-cost-of-failure-in-drug-development-5813046/

COMPANY SPOTLIGHT

AINMF: OTCQB

AIAI : CSE

Download a free investor package.

Input your Information below:

CORPORATE VIDEOS:

NetraMark – A Discussion With Dr. Luca Pani

Netramark’s CEO and President discuss recent corporate events and their outlook for the year ahead

Sequire Spotlight Presents NetraMark Holdings Inc. (AINMF)

6 REASONS NETRAMARK HOLDINGS (AINMF:OTCQB, AIAI:CSE) IS OUR TOP AI PICK TODAY:

1)

State-of-the-Art Artificial Intelligence:

- The $1.48 TRILLION pharmaceutical industry could be next in line to benefit from the ongoing AI revolution. NetraMark’s innovative proprietary platform uses state-of-the-art machine learning to redefine the clinical trial process.

2)

A Potential ‘No-Brainer’ for Drug Companies:

- The estimated cost to bring just one drug to market is $2.6 billion, and typically takes 10 to 15 years’ time. With a price point of just $100 to $350k, NetraAI could equate to just 0.01% of the drug’s overall R&D budget… And when Phase III trials alone can cost over $340 million, NetraAI could be a compelling solution for drug companies to help de-risk their clinical trials.

3)

The Multiplier Effect Could substantially increase Sales:

- Pharmaceutical companies aren’t usually in trials for just one drug… but many. Just one success with one drug could significantly increase NetraMark’s revenue – if that pharmaceutical company begins to enlist NetraAI for all of their trials.

4)

A Team of Connected Experts:

- Dr. Joseph Geraci, the mathematical genius who created NetraAI, is just one part of NetraMark’s secret sauce. The company is supported by a full team of AI and pharmaceutical experts with deep ties to the pharmaceutical industry including former executive positions at Pfizer, Novartis and J&J – which could help to get NetraMark’s foot in the door with the top companies across the globe.

5)

Unique Approach:

- There are very few options like NetraAI on the market today. The platform is unique in its ability to analyze an extremely small data set to redefine the way we understand and diagnose disease, on an easy to use and interactive platform.

6)

READY FOR MARKET TODAY & ALREADY LANDING NASDAQ-LISTED CLIENTS:

- NetraMark has gone through 7+ years of product development, a lengthy quality assurance process that meets GxP Guidelines and FDA regulations. The company has already successfully landed contracts with a NASDAQ-listed biopharma company, meaning NetraAI is ready to hit the market today!